An Investment Process that has Delivered—with Integrity

Our process works: Strategic’s disciplined, robust, and repeatable investment process has helped our clients to fulfill their purpose for 37 years.

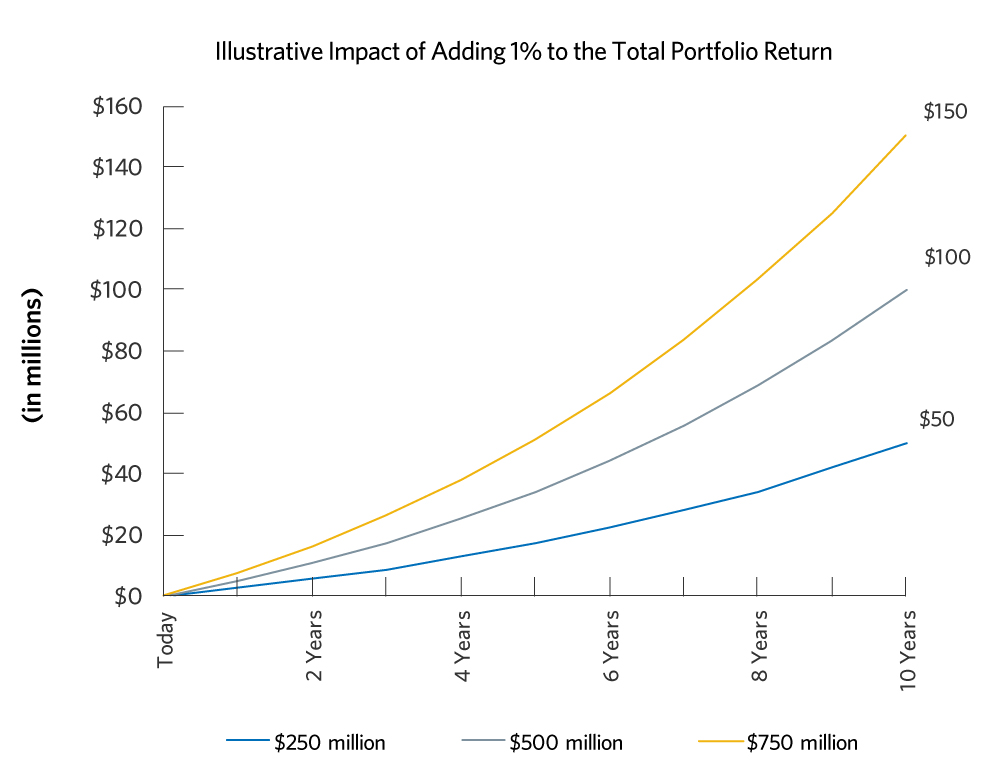

This graph does not represent actual investments or trading activity of Strategic. It is designed to illustrate the approximate return in dollars of a 1% incremental improvement in annual performance from 8% annualized to 9% annualized. There is no guarantee that Strategic will outperform its benchmark or peers.

Strategic is GIPS® (Global Investment Performance Standards) compliant. This designation is the gold standard of performance measurement principles, recognized around the world for lending credibility, integrity, and uniformity to performance reporting by enabling direct comparability of a firm’s track record. Thus, our results—unlike those of many of our competitors—are independently verified by a third party.

Our 43 investment professionals, led by a seasoned and stable leadership team with an average of over 12 years with the firm, create customized portfolios for our clients. With 37 discretionary OCIO relationships representing $31.4 billion in assets under management, we offer our clients deep resources and considerable purchasing power.

We know that markets are complex bundles of interrelated risks and opportunities, and we have built proprietary risk systems that analyze the holdings of each client—not one model portfolio. Our risk management team monitors every client portfolio daily to ensure that they are optimally allocated. This allows us to minimize surprises and navigate through stormy seas.

A Disciplined, Robust, and Repeatable Investment Process

Yes, OCIOs Can Be GIPS Compliant

Strategic Investment Group® ("Strategic") claims compliance with the Global Investment Performance Standards ("GIPS®"). To obtain a fully compliant GIPS report, please contact us at info@strategicgroup.com.

GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.